This Tuesday brought much anticipated yet dreaded news for the Sri Lankan workforce. They have been aware that there will be a lot of weight to be shouldered as the labor force of the country in order to help the country recover from its downward spiral. The government has issued a press release on the tax reforms proposed to be implemented in the immediate and short term. These changes are expected to be implemented starting October 1st 2022. This article aims to explain what these changes would mean to employers and their employees in the coming months.

Why tax reforms?

The instability of the economy of Sri Lanka is no secret to the common public of the island. The majority of the workforce of Sri Lanka has been anxiously waiting to learn what measures would be taken by the government to mitigate the effects of the downward trajectory of the economy in the coming years and what it would mean for the citizens of Sri Lanka.

The low tax regime implemented through exemptions and incentives in late 2019 and how COVID-19 has impacted revenue mobilization and the pandemic relief measures widened the budget deficit over the past two years.

These factors resulted in a fiscal imbalance with significant adverse spillover effects on the economy. Sri Lanka’s economic outlook is vulnerable to unforeseen inflationary pressures, continuous large fiscal and balance of payment financing need, large debt overhang and critically low reserve levels and pressures on the exchange rate. Economic growth will be negatively affected by the foreign currency shortage and ensuing economic conditions prevailing in the country, and loss of business and investor confidence due to credit rating downgrades.

Tax reforms which include Income Tax (PIT), value added tax etc, are parts of the strong fiscal consolidation plan that is expected to be implemented immediately.

Personal Income tax changes

There are two significant changes expected in personal income tax (PIT).

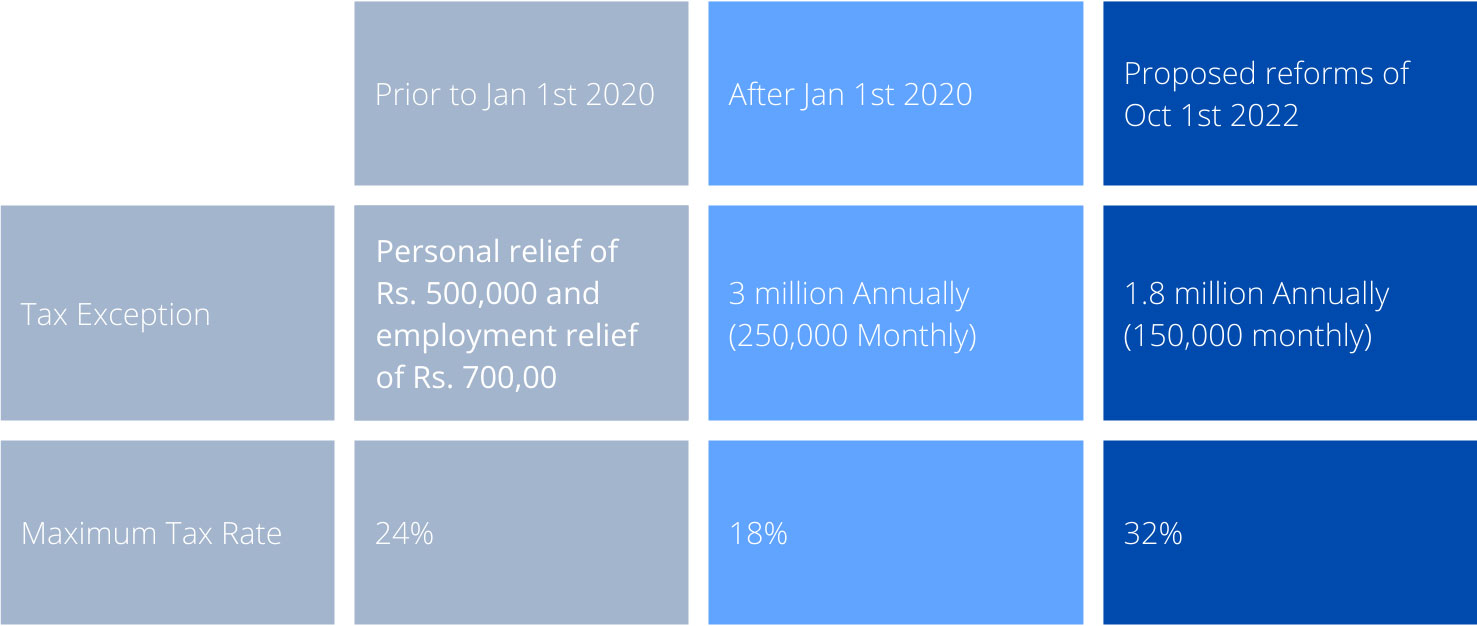

1. Firstly, the tax exemption would be reduced to 1.8 million from the previous 3 million, while the maximum tax rate will also increase to 32% from the last 18%.

2. Secondly, It is proposed that withholding personal income tax from their employees will be made mandatory for employers.

a) Personal Income Tax (PIT)

The country has been paying personal income taxes with an annual tax exemption of LKR 3 million translating to LKR 250,000 monthly since the tax reforms of Jan 1, 2020. With tax rates starting from 6% with the maximum tax rate being 18%. It is proposed that the annual tax exception for an individual will be lowered to LKR 1.8 million, meaning the monthly tax exception would amount to LKR 150,000. Once the annual income exceeds 1.8 million tax slabs will be structured as such LKR 1.2 million is added at each slab. Here the tax rates on each slab are expected to start at 4% with the maximum tax rate of 32%.

The proposed tax reforms are expected to be implemented through amendment to the inland revenue act No 24 of 2017. Considering the existing advanced personal income tax structure (tax table 1) and the government press release by the Prime Minister’s Media Division dated 2022.05.31, proposed tax structure would take shape as below.

| Annually | Monthly | Tax Rate |

|---|---|---|

| Up to 1.8 million | >/= 150,000 | Exempted |

| First 1.2million (3 million) | 150,001 - 250,000 | 4 |

| Next 1.2 million (4.2 million) | 250,001 - 350,000 | 8 |

| Next 1.2 million (5.4 million) | 350,001 - 450,000 | 12 |

| Next 1.2 million (6.6 million) | 450,001 - 550,000 | 16 |

| Next 1.2 million (7.8 million) | 550,000 - 650,000 | 20 |

| Next 1.2 million (9 million) | 650,001 - 750,000 | 24 |

| Next 1.2 million (10.2 million) | 750,001 - 850,000 | 28 |

| On balance | 850,000 < | 32 |

Example 01

Kasun is an employee who earns a salary of 3 million annually, where he earns approximately LKR 250,0000 a month. Since his annual salary after deducting the exempted 1.8 million is 1.2 million, his personal income tax will be calculated only according to the first slab at a rate of 4%

| Tax Rate | Tax amount (annual) | Tax amount (Monthly) | ||

|---|---|---|---|---|

| Up to 1.8 million | Exempted | 0 | 0 | |

| First 1.2 million | 4% | 1,200,000*4% | 48,000 | 4,000 |

| Total = 3 million | Total | 48,000 | 4,000 |

Example 02

Rochelle is an employee who earns a salary of 5.4 million annually, which usually amounts to a monthly salary of LKR 450,000. Her personal income tax will be calculated according to 3 different slabs and the total tax amount due is calculated by adding the tax amounts. Up to 1.8 million she is exempted from taxes; the remaining amount is taxed at 4%, 8% and 12% respectively for each 1.2 million rupees after that.

| Tax Rate | Tax amount (annual) | Tax amount (Monthly) | ||

|---|---|---|---|---|

| Up to 1.8 million | Exempted | 0 | 0 | |

| First 1.2million | 4% | 1,200,000*4% | 48,000 | 4,000 |

| Next 1.2 million | 8% | 1,200,000*8% | 96,000 | 8,000 |

| Next 1.2 million | 12% | 1,200,000*12% | 114,000 | 9,500 |

| Total = 5.4 million | - | 258,000 | 21,500 |

Example 03

John earns a salary of 6 million annually, which reflects in his monthly salary which averages to LKR 500,000. His personal income tax will be calculated according to the five different slabs. Up to 1.8 million he is exempted from taxes; the remaining amount is taxed at 4%, 8% and 12% respectively for each 1.2 million rupees after that. It is important to note that the balance amount left after the first three tabs is only LKR 600,000 which is taxed at a rate of 16%. The cumulative value of all the resulting amounts is his total tax value.

| Tax Rate | Tax amount (annual) | Tax amount (Monthly) | ||

|---|---|---|---|---|

| Up to 1.8 million | Exempted | 0 | 0 | |

| First 1.2million | 4% | 1,200,000*4% | 48,000 | 4,000 |

| Next 1.2 million | 8% | 1,200,000*8% | 96,000 | 8,000 |

| Next 1.2 million | 12% | 1,200,000*12% | 114,000 | 9,500 |

| Next 1.2 million (0.6 million) | 16% | 600,000*16% | 96,000 | 8,000 |

| Total = 6 Million | Total | 354,000 | 29,500 |

Withholding Tax (WHT)

Effective from April 1, 2020, the Advance Personal Income Tax (APIT) was introduced for employment income, and it is a compulsory deduction on the relevant payments made by an employer to non-residents and non-citizens but optional for residents and citizens. The employees had to express their consent to deduct and remit the APIT amount to the Inland Revenue Department. Employees who chose to remit APIT on their own could do that. However, following the proposed tax reforms, APIT/ Withholding Tax on Employment Income (PAYE) is mandatory for all taxpayers exceeding the personal relief of Rs. 1.8 million per year of assessment effective from October 1, 2022.

Therefore, employers will be strained to take on more responsibilities in order to calculate, deduct, and remit these taxes while maintaining proper documentation like the primary employment declaration, an annual statement by the employer, T10 etc.