Expense reimbursements often operate in a silo across most small businesses. Across many Sri Lankan SMEs, employees submit claims via email or on paper, managers review them when they find time, and reimbursements are processed sporadically. This scattered approach not only delays payments to staff but also creates inconsistencies in recordkeeping and cash flow management.

By linking expense approvals directly to payroll cycles, small businesses can simplify reimbursements, improve transparency, and keep their financial systems tightly integrated.

Brings Structure to Reimbursements

Aligning expense approvals with payroll ensures that there’s a consistent timeline for when employees receive their reimbursements. Instead of chasing ad hoc payment requests, employees know that their approved claims will be processed with their monthly salary.

This rhythm encourages staff to submit claims on time, helps managers prioritize reviews within a known timeline, and prevents the finance team from scrambling to make off-cycle payments.

For example, if your payroll is processed on the 25th of every month, setting a cut-off date (such as the 20th) for expense submissions ensures that there’s enough time to verify, approve, and include them in the payroll run.

Reduces Manual Work for Finance Teams

When expense reimbursements are tied to payroll, finance teams only need to process one consolidated payment per employee, salary plus approved expenses. This is far more efficient than initiating separate transactions for each reimbursement.

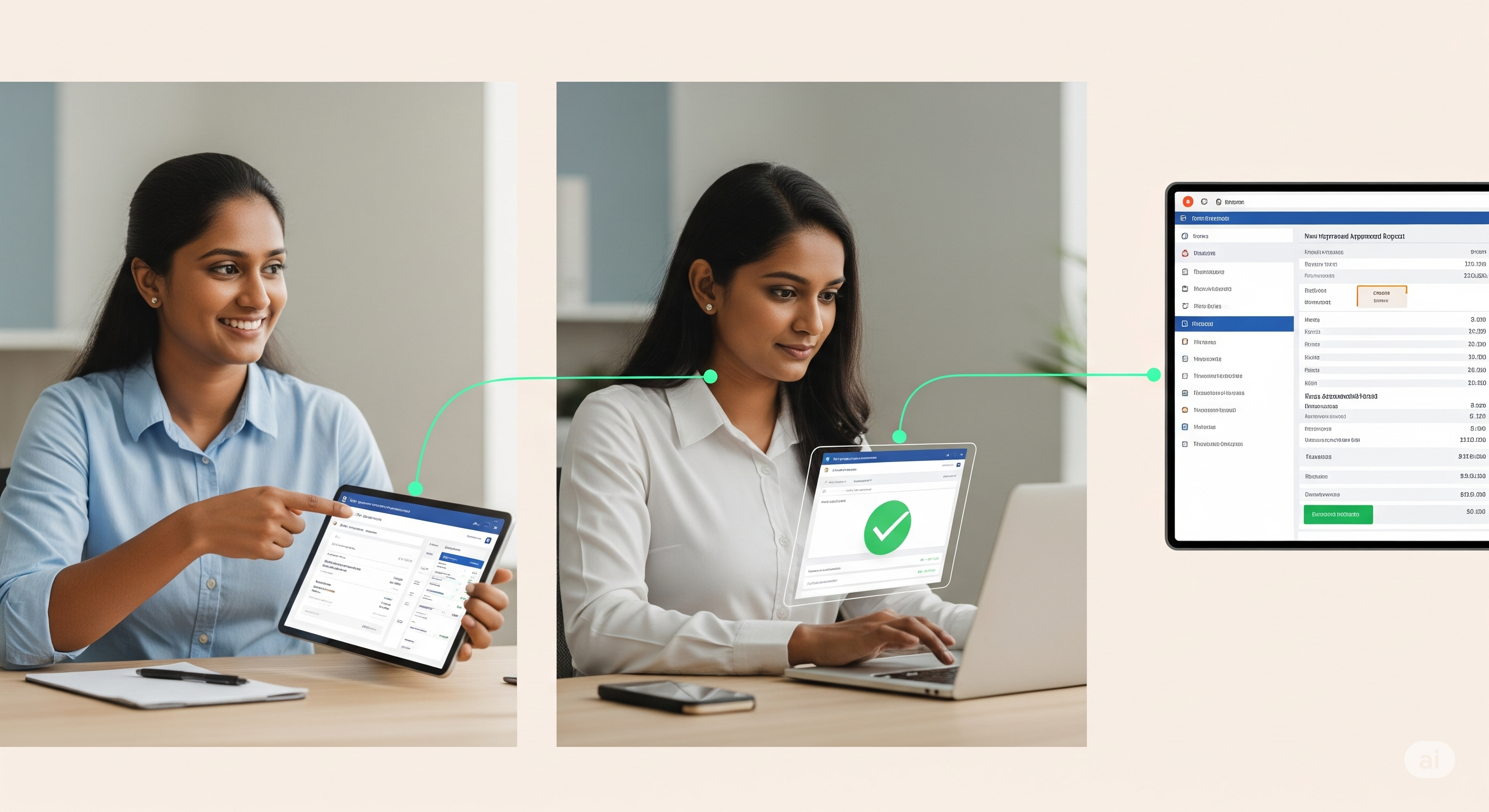

Many HRIS systems that offer expense tracking allow you to pull approved claims into payroll with just a few clicks. That means no more cross-referencing Excel sheets or manually calculating reimbursement totals. The entire process becomes part of the standard payroll workflow.

Improves Cash Flow Visibility

Managing cash flow is one of the most important and most challenging tasks for SMEs. Unstructured expense reimbursements can quickly create gaps in expected outflows.

By synchronizing expense payments with payroll, businesses gain a clearer picture of monthly liabilities. You can forecast cash requirements more accurately, plan ahead for peak months, and avoid surprises caused by last-minute or forgotten expense claims.

This becomes even more valuable when your business is scaling. With more employees and more frequent expense claims, keeping things predictable helps keep your finances stable.

Encourages Policy Compliance

When employees know that claims are tied to payroll, they’re more likely to follow the correct process and timelines. It also becomes easier to enforce policy rules such as expense limits or required documentation because the consequences of missing the cut-off are immediate.

In contrast, a loosely run expense process often leads to:

- Late submissions

- Missing receipts

- Inflated or non-compliant claims

Tying reimbursement to payroll creates a natural incentive for both employees and managers to stay within policy.

A Better Employee Experience

Delays in expense reimbursements can affect morale. Employees may feel frustrated when out-of-pocket expenses are not reimbursed on time, especially for work-related travel, meals, or supplies.

A regular, predictable reimbursement schedule improves trust and shows that the company values employees’ contributions and time. When expenses are processed and paid together with salaries, it creates a smooth and professional experience.

How to Implement This in Your SME

If you’re using HR and payroll software, this integration is usually straightforward. Here’s what you can do:

- Set a monthly deadline for submitting expense claims

- Ensure that managers complete approvals before the payroll processing date

- Configure your software to pull approved expenses into payroll

- Communicate the process clearly to employees

Once this is in place, your team will quickly adapt to the new workflow, and you’ll begin to see the benefits across finance, operations, and employee satisfaction.

For SMEs in Sri Lanka looking to bring more structure and efficiency into their operations, linking expense approvals to payroll cycles is a simple but powerful move. It’s not just about automation, it’s about building habits that support growth and transparency.